The Ultimate Guide To San Diego Home Insurance

Wiki Article

Secure Your Assurance With Reliable Home Insurance Coverage

Why Home Insurance Policy Is Essential

The relevance of home insurance policy depends on its capability to give financial protection and assurance to house owners in the face of unexpected events. Home insurance coverage acts as a security web, supplying coverage for damages to the physical framework of the home, individual belongings, and liability for accidents that may take place on the building. In case of natural catastrophes such as floods, fires, or earthquakes, having a comprehensive home insurance policy can help homeowners reconstruct and recover without facing substantial monetary concerns.Furthermore, home insurance is usually needed by mortgage lenders to shield their investment in the residential property. Lenders intend to ensure that their economic rate of interests are safeguarded in instance of any kind of damage to the home. By having a home insurance coverage in place, home owners can satisfy this requirement and protect their investment in the building.

Kinds of Insurance Coverage Available

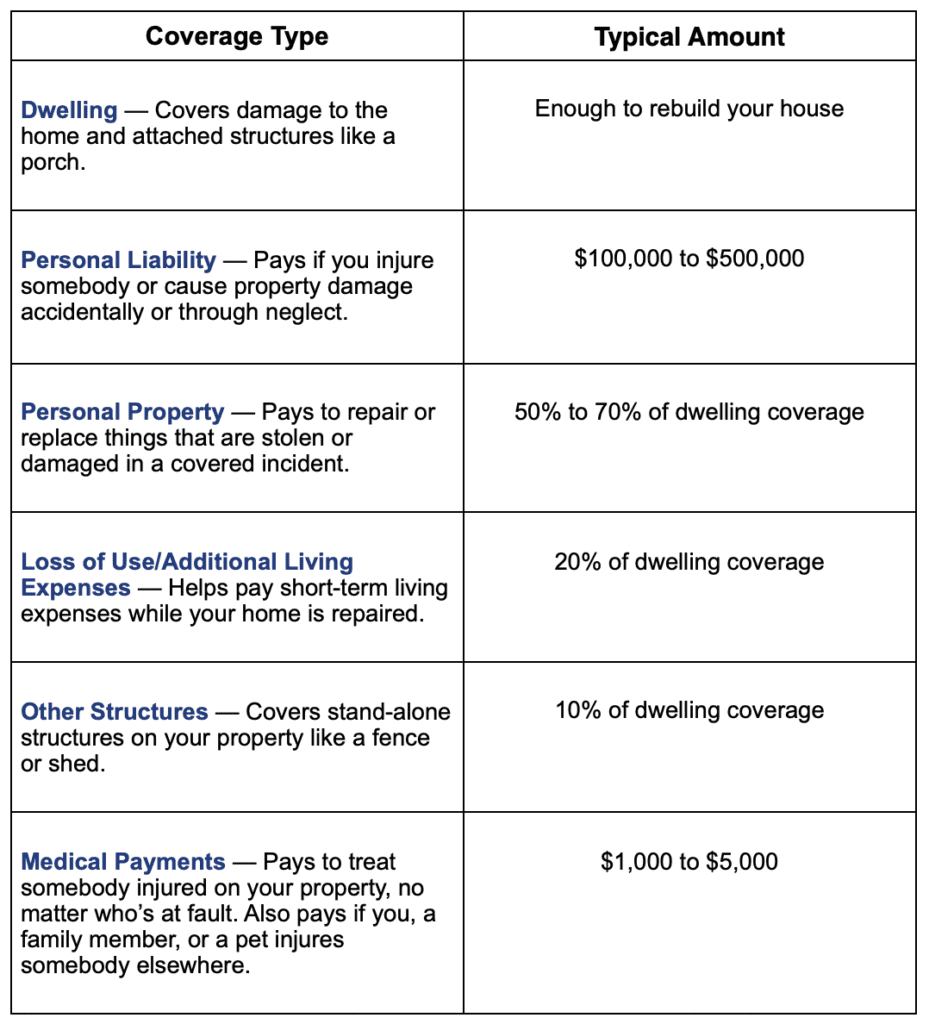

Given the value of home insurance policy in shielding property owners from unforeseen monetary losses, it is critical to understand the various types of protection offered to customize a plan that matches specific needs and scenarios. There are a number of crucial kinds of coverage offered by a lot of home insurance plan. The first is residence coverage, which secures the framework of the home itself from threats such as fire, criminal damage, and all-natural calamities (San Diego Home Insurance). Individual residential or commercial property protection, on the various other hand, safeguards items within the home, including furniture, electronics, and clothes. Liability protection is vital for securing property owners from medical and lawful expenditures if somebody is harmed on their residential property. Additional living expenses insurance coverage can help cover costs if the home comes to be unliveable due to a protected loss. It is very important for property owners to carefully review and understand the various kinds of coverage readily available to ensure they have ample security for their details requirements.Factors That Impact Premiums

Factors influencing home insurance premiums can differ based on an array of factors to consider particular to individual situations. Older homes or residential properties with out-of-date electrical, plumbing, or home heating systems might present higher risks for insurance policy business, leading to higher costs.Furthermore, the protection limitations and deductibles picked by the insurance policy holder can affect the costs amount. Going with higher insurance coverage limitations or reduced deductibles normally results in greater costs. The sort of building products utilized in the home, such as wood versus block, can also influence premiums as specific products may be extra prone to damages.

Just How to Select the Right Plan

Selecting the ideal home insurance plan includes cautious consideration of various essential elements to make certain comprehensive coverage customized to specific demands and scenarios. To start, assess the worth of your home and its materials accurately. Recognizing the replacement expense of your home and valuables will certainly help determine the coverage limitations required in the policy. Next, take into consideration the different kinds of coverage available, such as residence coverage, personal effects coverage, liability security, and additional living expenses insurance coverage. Dressmaker these insurance coverages to match your certain demands and risk variables. In addition, assess the plan's exclusions, restrictions, and deductibles to guarantee they straighten with your economic capabilities and run the risk of resistance.Furthermore, reviewing the insurance provider's track record, economic security, client solution, and declares process is important. Seek insurance providers with a history of reputable this contact form solution and prompt cases settlement. Lastly, contrast quotes from multiple insurance companies to locate an equilibrium between price and coverage. By thoroughly reviewing these aspects, you can choose a home insurance coverage that offers the necessary defense and satisfaction.

Advantages of Reliable Home Insurance Policy

Reputable home insurance uses a feeling of safety and defense for property owners against monetary losses and unexpected occasions. Among the essential benefits of dependable home insurance coverage is the assurance that your property will be covered in the event of damages or destruction triggered by all-natural catastrophes such as floodings, fires, or tornados. This coverage can aid home owners stay clear of bearing the complete cost of repair services or restoring, offering satisfaction and monetary stability during challenging times.In addition, trusted home insurance plan usually consist of responsibility protection, which can safeguard homeowners from clinical and lawful costs when it comes to accidents on their residential or commercial property. This protection extends past the physical structure of the home to shield against claims and claims that may arise from injuries suffered by visitors.

Moreover, having reliable home insurance can likewise contribute to a sense of total well-being, recognizing that your most significant financial investment is protected against numerous risks. By paying regular premiums, house owners can alleviate the possible financial burden of unanticipated occasions, permitting them to concentrate on appreciating their homes without constant bother with what might take place.

Conclusion

In conclusion, protecting a trustworthy home insurance plan is necessary for safeguarding your home and possessions from unforeseen events. By understanding the kinds of insurance coverage offered, aspects that impact premiums, and how to pick the best policy, you can guarantee your peace of mind. Trusting in a reputable home insurance provider will certainly offer you the advantages of financial defense and safety and security for your most useful possession.Navigating the realm of home insurance can be complicated, with different coverage choices, plan aspects, and factors to consider to consider. Comprehending why home insurance coverage is necessary, the kinds of protection readily available, and just how to choose the appropriate policy can be crucial in ensuring your most substantial financial investment remains safe.Offered the value of home insurance coverage in protecting home owners from unanticipated economic losses, it is critical to recognize the different kinds of insurance coverage offered to tailor a policy that matches specific requirements and circumstances. San Diego Home Insurance. There are numerous key kinds of protection check out this site used by the majority of home insurance coverage plans.Picking the suitable home insurance coverage policy entails careful factor to consider of numerous essential facets to Homepage make certain comprehensive coverage tailored to specific needs and scenarios

Report this wiki page